Planning for the Future: Why Every Adult Should Have a Will ?

Losing a loved one—whether a friend, colleague, relative, or neighbour—often brings a sense of grief and uncertainty. Life is unpredictable, but we are responsible for ensuring the well-being of those we leave behind. A will is a final gesture of care, providing clarity and security for your family in your absence.

What Is a Will?

A will is a legally binding document that outlines your wishes regarding the distribution of your assets, guardianship of dependents, and other essential matters after your passing. It ensures that your estate is handled according to your instructions, preventing legal complications and disputes. A well-drafted will can:

- Appoint an executor to manage your estate.

- Designate beneficiaries for your assets.

- Assign guardianship for minors.

- Specify charitable donations or notable bequests.

Also Read: Government Bonds | Part 2

Why a Will Is Essential

- Asset Distribution: A will ensures your property and assets are distributed as per your wishes rather than default legal provisions, which may not align with your intentions.

- Clarifying Beneficiaries vs. Nominees: A nominee temporarily holds the property on behalf of the legal heirs, while a beneficiary is the person or entity that ultimately inherits the assets. A will helps differentiate the two, avoiding confusion.

- Expressing Final Wishes: Your will allows you to document personal messages and final instructions for loved ones.

- Guardianship for Minors and Pets: If you have children under 18 or dependents (including pets), a will lets you appoint a trusted guardian for their care.

- Minimizing Family Disputes: A will helps prevent conflicts among family members by clearly outlining how assets should be distributed.

- Charitable Contributions: You can leave a portion of your estate to charities or causes that matter to you, ensuring your legacy has a lasting impact.

Key Elements of a Legally Valid Will

To be legally enforceable, a will must include:

- Testator: The individual creating the will.

- Beneficiaries: Those who will inherit the assets.

- Executor: A trustworthy person responsible for executing the will. He ensures that the distribution of assets and liabilities is carried out as mentioned in the will.

- Witnesses: Individuals who attest to the validity of the will.

- Preamble: A declaration given as the preamble of the will identifies the testator, their age and domicile, and declares that the document has been made voluntarily i.e. without any threat or coercion and that it is their Last Will and Testament.

- Revocation Clause: Ensures that previous wills, if any, are revoked.

- Asset Distribution Plan: This plan clearly instructs how assets will be divided amongst the beneficiaries, along with their respective rights and shares.

- Guardianship Provisions: If applicable, assign a guardian for minors.

- Special Instructions: The will can include instructions regarding matters like– Funeral arrangements, Organ donations, or other personal wishes.

Steps to Create a Will

- Determine the Type of Will: Choose a simple will, testamentary trust will, or joint will.

- List Your Assets: Include property, investments, bank accounts, and valuables.

- Identify Beneficiaries: Specify who will inherit the legacy along with the proportion and rights in the assets.

- Appoint an Executor: Select a trusted person to carry out your will.

- Choose a Guardian (if needed): Assign responsibility for minor children, dependents, or Pets.

- Specify Bequests: Outline gifts to individuals, organizations, or charities.

- Plan for Debts & Taxes: Provide instructions for handling financial obligations.

- Include Digital Assets: Decide how online accounts such as Email Accounts, Instagram and other social media accounts, and digital assets will be accessed and managed after your demise.

- Store Your Will Safely: Keep it secure and inform the executor.

Legal Considerations

- Testamentary Capacity: You must be of sound mind and free from coercion when making a will.

- Witness Requirements: Witnesses must be competent adults and not beneficiaries.

- Signature & Date: A will must be signed and dated for legal validity.

- Revocation & Updates: A will can be altered or revoked at any time by creating a new will or codicil.

- Legal Challenges: Ensure your will is drafted correctly and legally sound to avoid disputes.

- Intestate Succession: Without a will, assets are distributed according to legal succession laws, which may not reflect your wishes.

Also Read: Government Bonds | Part 1

Common Myths About Wills

Myth: Wills are only for the elderly.

Fact: Anyone with assets or dependents should have a will, regardless of age.

Myth: Only the wealthy need wills.

Fact: A will protects even modest assets and sentimental possessions.

Myth: Creating a will is complicated.

Fact: It is a straightforward process, and legal advice can simplify it further.

Myth: My loved ones will inherit automatically.

Fact: Probate can be lengthy and costly without a will, delaying inheritance.

Take Control of Your Legacy

Creating a will while in good health ensures that your loved ones are taken care of and that your assets are distributed according to your wishes. It also saves your family from unnecessary legal complications.

Consult an experienced attorney to draft a legally sound will that reflects your specific needs and protects your legacy.

Share This On Social

![Sangeeta-Relan-AH-525×410[1]](https://slategray-flamingo-696901.hostingersite.com/wp-content/uploads/2024/06/Sangeeta-Relan-AH-525x4101-1.jpeg)

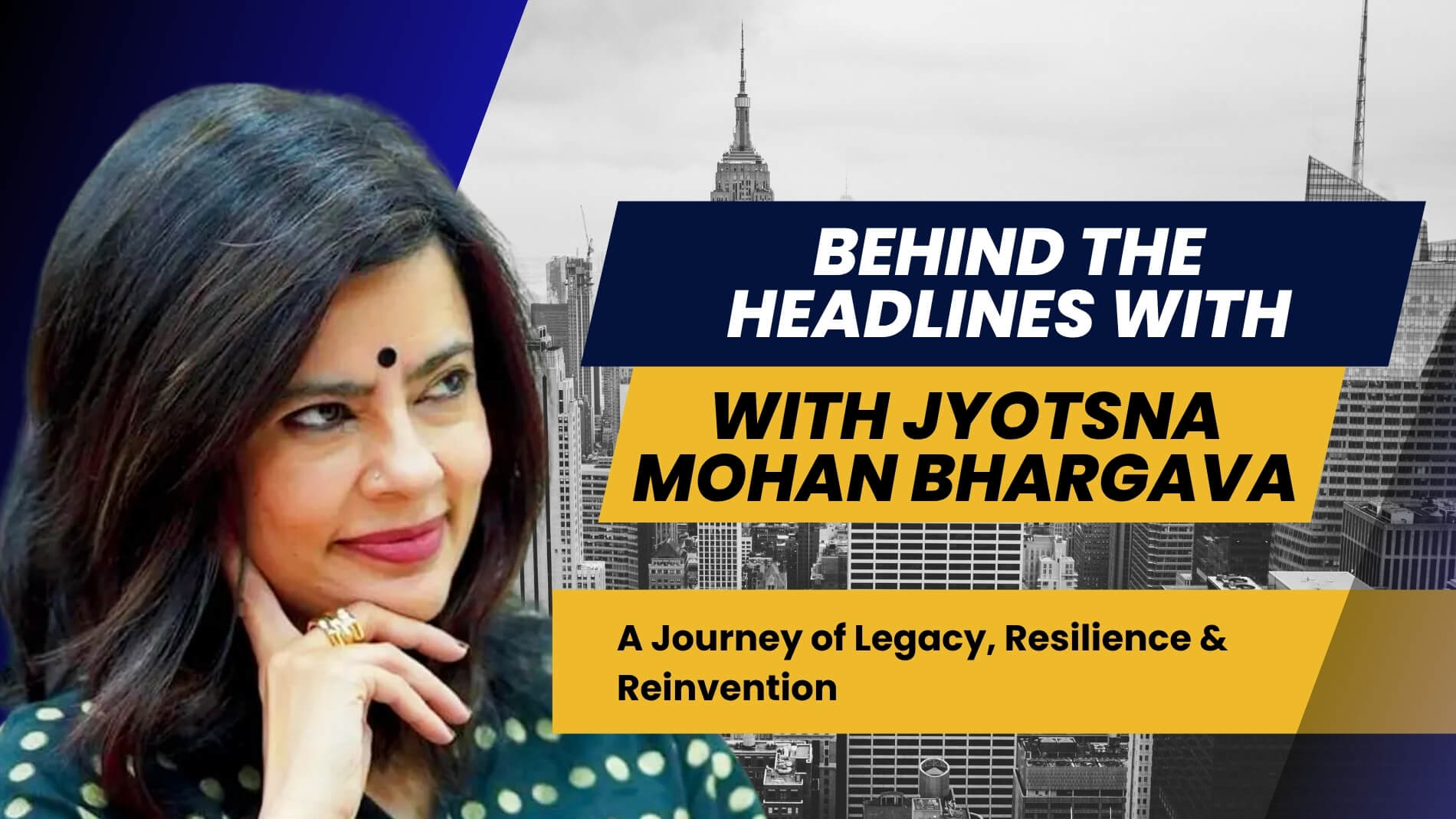

I’m Sangeeta Relan—an educator, writer, podcaster, researcher, and the founder of AboutHer. With over 30 years of experience teaching at the university level, I’ve also journeyed through life as a corporate wife, a mother, and now, a storyteller.

Recent Posts